Frictionless fun: How fintech is revolutionising the UK entertainment sector

The UK entertainment landscape has undergone a striking transformation in the last decade. From how we watch movies and attend festivals to how we play games or stream music, one element has quietly fueled this evolution: fintech. As financial technology solutions become faster, smarter, and more seamless, they are enabling new kinds of consumer experiences that feel, quite simply, frictionless.

Whether it’s buying a last-minute concert ticket with one tap or instantly topping up an online gaming wallet, fintech has reshaped the expectations of how payments should feel: instant, secure, and invisible. And while that might sound simple, behind the scenes are deeply sophisticated technologies driving this shift.

Let’s look closer at how fintech is reinventing the very core of entertainment in the UK, with real-world examples that show where we’re headed next.

Instant payments, zero hassle

Think about booking a movie on a Friday night. A few years ago, you might have waited in line, paid at the box office, or gone through a clunky online checkout. Today? Open an app, use Apple Pay or Google Pay, and you’re done in seconds. Thanks to payment gateways that integrate with mobile wallets, entertainment venues can now offer rapid, tap-and-go payment experiences, no cards, no PIN codes, no interruptions.

Take platforms like Odeon and Vue. They’ve revamped their apps to allow seamless booking and digital ticket delivery. Meanwhile, smaller indie cinemas are jumping on similar solutions through services like SumUp and Zettle, enabling faster payments even at pop-up screenings or food-and-film nights.

This same frictionless approach is now common in gaming, where players can purchase new content or in-game items without ever leaving the action. In video gaming, consoles and mobile platforms have adopted instant microtransactions powered by fintech, making digital purchases smoother than ever.

The shift is equally visible in online gaming, where participants expect fast top ups, quick access, and secure identity checks. Many platforms now let users choose a type of bank transfer that best suits their preferences, be it through open banking apps, instant payment services, or traditional options, streamlining the experience while keeping everything safe and compliant.

Behind these changes are technologies like tokenisation and biometric authentication that keep payments safe without slowing things down.

The rise of subscription culture

Streaming platforms like Netflix, Spotify, and Disney+ have built empires around recurring payments. But fintech made the engine run smoothly.

Automated billing systems using open banking APIs, real-time account verification, and AI-powered fraud detection mean subscribers rarely need to think about their payments. It’s why you can binge-watch an entire season or stream your favourite playlist without ever wondering, “Did that payment go through?”

Even beyond traditional media, platforms like Patreon and Substack have built creative economies where fans support creators with micro-subscriptions, an idea that would have been unthinkable without low-cost fintech-enabled transactions.

Right under the surface, fintech quietly handles the logistics: managing recurring transactions, ensuring regulatory compliance, and offering flexibility. Want to pay monthly, quarterly, or annually? It’s possible because the back-end systems now support it instantly, regardless of volume or geography.

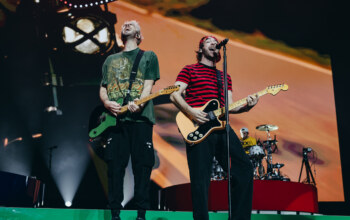

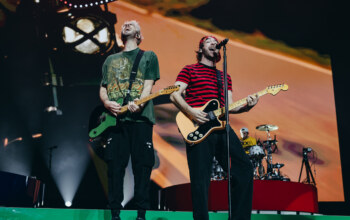

Fintech and the Festival Experience

Cash is fading fast on the UK festival scene. Events like Glastonbury, All Points East, and Latitude have embraced cashless tech, from RFID wristbands loaded with funds to contactless bars and food vendors.

Why? Because payments are faster, queues are shorter, and spend per visitor actually increases. A 2023 survey by UK Finance found that over 86% of UK event-goers preferred using contactless payments, citing ease and hygiene as top reasons.

Platforms like Festicket and Eventbrite also enable multi-currency support and dynamic pricing. With integrated fintech tools, these ticketing platforms offer real-time updates on availability, secure resale features, and flexible payment plans for premium experiences, like backstage passes or VIP lounges.

Even smaller festivals are experimenting with pay-later models via fintech services like Klarna or Clearpay. Instead of shelling out hundreds up front, fans can spread the cost over time, making high-end experiences accessible to a broader audience.

Live entertainment embraces flexibility

From the West End to street performers in London’s South Bank, live entertainment has found new ways to integrate fintech.

Street performers now carry QR codes for contactless donations through apps like SumUp or PayPal Zettle. Some even link directly to a Buy Me a Coffee page, letting audiences show appreciation without needing spare change.

Larger venues like The O2 or the Royal Albert Hall offer mobile pre-orders for drinks and snacks, with payment handled in advance. It’s not just about speed; it’s about freeing up staff and avoiding bottlenecks that can break immersion for the audience.

Even more niche areas, such as immersive theatre experiences and escape rooms, are exploring fintech-backed booking platforms that include custom pricing, deposits, and refund policies. Thanks to flexible fintech integrations, entertainment venues now offer tiered pricing based on date, seat, and extras, all managed effortlessly behind the scenes.

NFTs and virtual events

While still evolving, fintech is opening doors to new digital ownership models in entertainment.

Artists and performers are experimenting with NFTs for ticketing, offering exclusive content or collectibles that live on blockchain systems. UK-based music platform Serenade allows fans to buy NFT tickets, offering perks like backstage access or merchandise bundles, all paid through crypto wallets or hybrid fintech platforms that convert fiat currency.

Virtual events, too, have leaned heavily into fintech. Whether it’s a paid Zoom concert, an interactive livestream, or a VR show, the transaction layer is now sleek, secure, and multi-currency, allowing access for a global audience with minimal friction.

Platforms like Dice and Universe have even added waitlist payments and auto-refund mechanisms, enhancing trust while reducing admin overhead.

What’s next? AI meets fintech in entertainment

The next wave is already here. AI-enhanced fintech is making entertainment even more personalised.

Imagine a ticketing platform that not only recommends a show but lets you pay in the exact way you prefer, detects your presence at the venue, and delivers personalised offers in real time.

Open banking tools are being used to understand user spending patterns to tailor offers. For example, regular concert-goers might receive early access notifications and flexible pay options before general release.

In streaming, AI combined with real-time payments may soon allow content creators to be paid per second viewed, enabled by fintech microtransaction models. We’re not far from real-time royalty payments becoming the norm in music and video.

Final takeaway: The future of fun is frictionless

Fintech isn’t just speeding up payments; it’s changing the shape of UK entertainment itself. From more inclusive access models to entirely new types of experiences, financial tech has become the silent engine of innovation across streaming, gaming, live events, and beyond.

As user expectations continue to shift towards immediacy, security, and flexibility, the entertainment sector will keep leaning on fintech to deliver not just better payments, but better experiences. And as we’ve seen, it’s not just about being faster, it’s about being smarter, fairer, and more fun.

The UK’s vibrant cultural scene is no longer powered just by creativity, but by the invisible, intelligent infrastructure that fintech provides. When money moves without effort, entertainment flows more freely than ever.

The editorial unit

Facebook

Twitter

Instagram

YouTube

RSS